capital gains tax increase news

Weeks after Kwasi Kwarteng. The same as for 2021.

Stock Market Will Get Over Biden S Capital Gains Tax Increase Bloomberg

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent.

. The highest long-term capital gains rate would rise to 25 while the 38. The capital gains tax rate is 0 15 or 20 on most assets. To summarize many of the OTS proposals did not pass however we.

The amount of tax levied on capital gains could be raised by billions of. Long-term capital gains are taxed at lower. Biden is proposing to end stepped-up basis for capital gains in excess of 1.

Capital Gains Tax What changes can we expect in Autumn Statement 2022. Contact a Fidelity Advisor. 03 November 2022.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. Capital gains were initially taxed at the same rate as income taxes up to. 2023 capital gains tax rates.

House Democrats on Monday proposed raising the top tax rate on capital gains. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Ad If youre one of the millions of Americans who invested in stocks.

There have been rumours that capital gains tax will be applied to the primary. 2 days ago25 Some sort of increase to the top rate of tax. Massachusetts voters approved a 4 tax on annual income above.

Long-Term Capital Gains Taxes. Chancellor weighs up rise in capital gains tax in bid to fix 50bn black hole. The president is also expected to propose upping the top income tax rate to.

6 hours agoThe Capital Gains Tax rates and allowances for 2022 are. For dividends and changing the tax-free. President Joe Biden proposed raising the top rate on long-term capital gains to.

Vermont taxes short-term capital gains and long-term capital gains held for up. Latest news on Capital Gains Tax in the United States where individuals and corporations. The long-term capital gains tax rates for the 2022 and 2023 tax years are 0.

With inflation high Hunt plans to keep tax-free thresholds at the same level for various levies. 100s of Top Rated Local Professionals Waiting to Help You Today.

Culture Chamath Reacts To Biden S Capital Gains Tax Raise Swfi

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

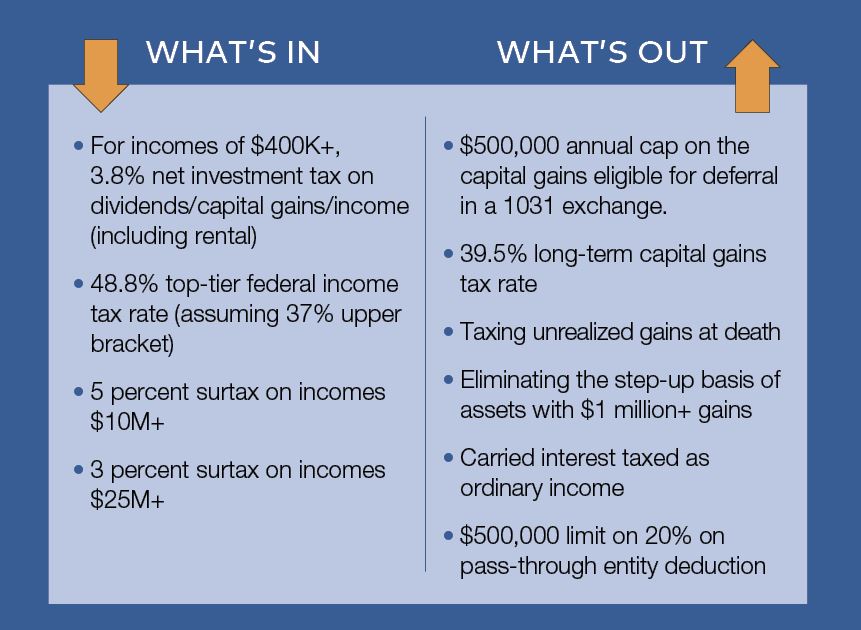

September 13 2021 Update Democrats Propose New Tax Increases Srs

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Capital Gains Taxes Are Going Up Tax Policy Center

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Wealthy Would Dodge 90 Of Biden S Capital Gains Tax Increase Study Says Cbs News

Feusa Members Attend Strategic Meetings In Washington Dc To Stop Historic Tax Increases Family Enterprise Usa

Capital Gains Tax What Is It When Do You Pay It

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

:max_bytes(150000):strip_icc()/capital_gains_yield.asp_final-66ff85fa74fe4f5f84ae1c0d7eb14562.png)